Aviation Insurance Market to Reach $5.75 Bn, Globally, by 2030 at 5.6% CAGR | Statistics Report

Aviation Insurance Market outlook

Aviation Insurance Market to Reach $5.75 Bn, Globally, by 2030 at 5.6% CAGR | Statistics Report

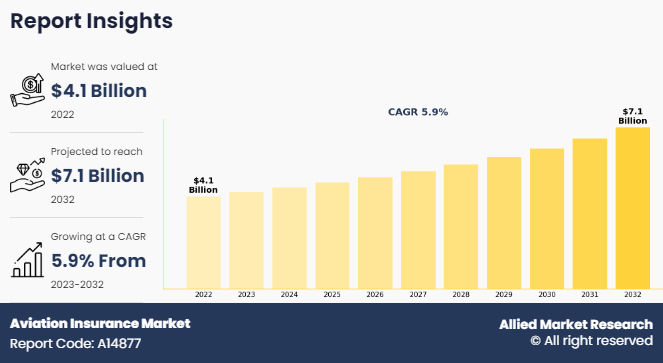

NEW CASTLE, WILMINGTON, UNITED STATES, May 10, 2024 /EINPresswire.com/ -- Allied Market Research published a report, titled, "Aviation Insurance Market by Insurance Type (Public Liability Insurance, Passenger Liability Insurance, Combined Single Limit (CSL), In-Flight Insurance, and Others) and Application (Commercial Aviation, General & Business Aviation and Others): Global Opportunity Analysis and Industry Forecast, 2021–2030."

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A14877

According to the report, the global aviation insurance industry generated $3.43 billion in 2021, and is anticipated to generate $5.75 billion by 2030, witnessing a CAGR of 5.6% from 2021 to 2030. Insurance products are designed to protect against a diverse range of risks, including accidents, incidents, damage to aircraft or property, bodily injury, loss of life, and third-party liabilities.

Prime determinants of growth

Rise in air passenger traffic and increase in government rules & regulations for passenger safety drive the growth of the global aviation insurance market. However, costly aviation insurance premium and increase in frequency and cost of claims hinder the market growth. On the other hand, surge in number of international airlines presents new opportunities in the coming years.

Covid-19 Scenario

The outbreak of the Covid-19 pandemic has a significant impact on the growth of the aviation insurance market size, mainly owing to large, well-documented claims from original equipment manufacturers (OEMs) in the aerospace division.

Moreover, a steady rise in passenger traffic led to an increase in government rules & regulations for passenger safety.

However, the reduced airline activity during the pandemic hampered the aviation insurance market as airline premiums are generally assessed according to hours flown. The global aviation premiums collected were down by an estimated 25% in 2020 as compared to 2019.

The aviation insurance market encompasses a specialized sector within the insurance industry that provides coverage for various aspects of aviation-related risks. This market caters to a wide range of stakeholders, including airlines, aircraft manufacturers, general aviation operators, airports, and aviation service providers.

The passenger liability insurance segment to maintain its leadership status throughout the forecast period

Based on insurance type, the passenger liability insurance segment held the highest market share in 2020, accounting for more than one-third of the global aviation insurance market, and is estimated to maintain its leadership status throughout the forecast period. This is owing to increase in interest toward passenger safety and easy way of allowing the organizations to keep recruitment operations secure. However, the in-flight insurance segment is projected to manifest the highest CAGR of 9.9% from 2021 to 2030, owing to increase in acceptance of aviation insurance and rise in interest toward aviation safety technology.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A14877

The commercial aviation insurance segment to maintain its lead position during the forecast period

Based on application, the commercial aviation insurance segment accounted for the largest share in 2020, contributing to more than three-fifths of the global aviation insurance market, and is projected to maintain its lead position during the forecast period. This is due to compensation of damages caused to the aircraft while in the particular airport. Moreover, the general and business aviation insurance segment is expected to portray the largest CAGR of 9.0% from 2021 to 2030, owing to growing diversification in aviation and improvement in aviation policies, which includes new types of aviation for flights schools, instructors, sky divers, and others.

Asia -Pacific, followed by North America, to maintain its dominance by 2030

Based on region, Asia-Pacific, followed by North America, held the highest market share in terms of revenue in 2020, accounting for nearly one-third of the global aviation insurance market. Moreover, the same region is expected to witness the fastest CAGR of 8.2% from 2021 to 2030. This is due to increase in aviation adoption and rise in awareness regarding aviation insurance in the region.

Leading Market Players:-

American International Group, Inc.

AXA

BWI Aviation Insurance

EAA

Global Aerospace, Inc.

Tokio Marine HCC

Travers & Associates Aviation Insurance Agency, LLC

STARR INTERNATIONAL COMPANY, INC.

USAA

USAIG

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/138381a476fab71dce9e6e0ab63919b9?utm_source=AMR&utm_medium=research&utm_campaign=P19623

Key Findings of the Study

By type, the passenger liability insurance segment accounted for the largest aviation insurance market size in 2022.

By application, the commercial aviation insurance segment accounted for the largest aviation insurance market share in 2022.

By product type, the airline segment accounted for the largest market share in 2022.

Region-wise, according to aviation insurance market analysis North America generated the highest revenue in 2022.

➡️𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞:

Life Reinsurance Market

https://www.alliedmarketresearch.com/life-reinsurance-market-A06698

Peer to Peer Lending Market

https://www.alliedmarketresearch.com/peer-to-peer-lending-market

Saudi Arabia Personal Loan Market

https://www.alliedmarketresearch.com/saudi-arabia-personal-loan-market-A74407

Medical Professional Liability Insurance Market

https://www.alliedmarketresearch.com/medical-professional-liability-insurance-market-A30183

Direct Insurance Carriers Market

https://www.alliedmarketresearch.com/direct-insurance-carriers-market-A09991

Pension Funding Market

https://www.alliedmarketresearch.com/pension-funding-market-A10021

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

David Correa

Allied Market Research

+18007925285 ext.

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.